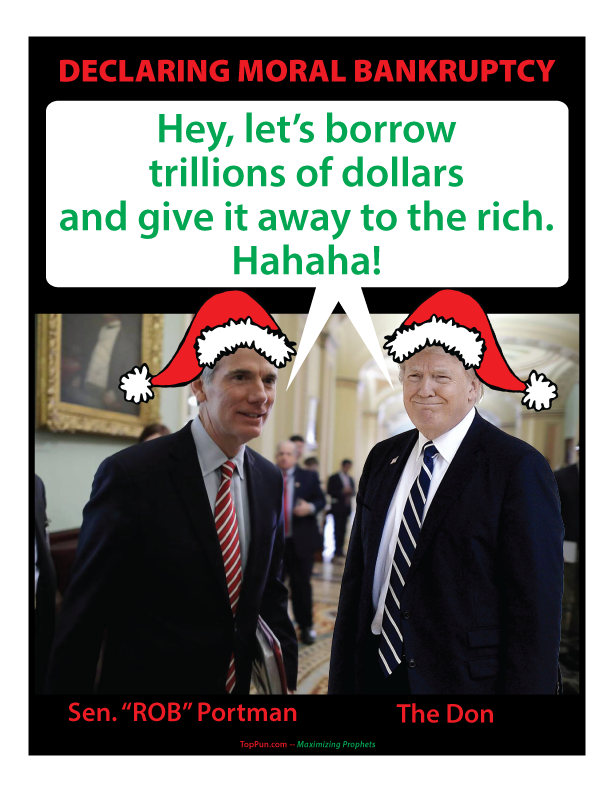

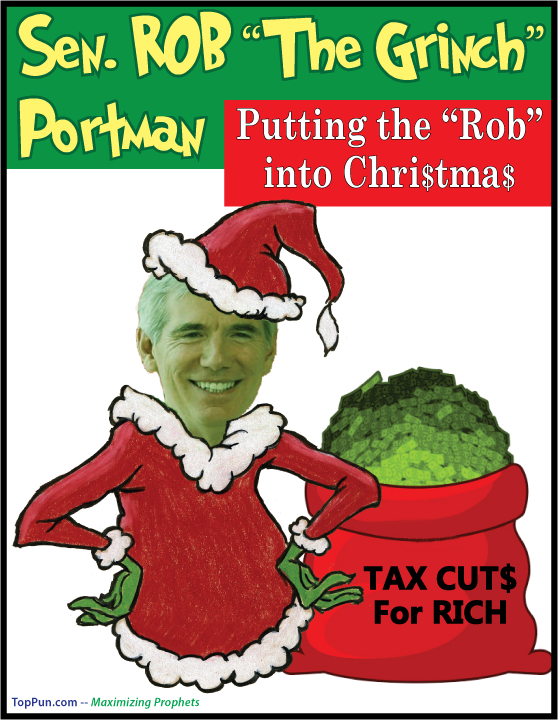

Sen. Rob Portman (R-OH) is well practiced at not speaking in truly public forums about his public policies and rationale. This lack of public accountability as an elected public official is a symptom of an ailing and dysfunctional democracy. This free poster, another addition to my “Parity or Parody” series of posters, speaks to the pathetically low bar of not speaking at all in order to avoid the web of lies that entangles one’s so-called public policy. Sen Rob Portman likes to portray himself as independent and he has tried to put political space between him and President Donald Trump; nevertheless, when it come to enacting legislation, he shows up as a highly reliable Trump Republican, a committed partisan. The current Republican tax bills seem to be no exception for Sen. Portman.

Sen. Portman seems to be relishing rather than merely stomaching the regressive taxation scheme, borrowing money from future generations to enrich the already rich, and standing predictably silent on the inevitable growing pressure to cut government programs, even major and popular entitlement programs like Medicare, Medicaid and Social Security, that benefit a broad swathe of Americans often referred to as the middle class and on much rarer occasion the poor. In public discourse, the poor are largely unmentioned, leaving us with the middle class and the rich, or as I might say, “the meddle class.”

If you are more of a policy wonk and want a concise yet detailed analysis of why ignoring deficit-financed tax cuts and ignoring future potential spending cuts, then take a look at The real cost of the Republican tax cuts, with excerpts here:

The primary stated goals of the tax plan are to raise economic growth and increase the after-tax incomes of middle-class households. But taking financing into account appropriately would show how unlikely it is that the plan will achieve those goals…

…But even if one believes the plan will increase the overall size of the economy, spending cuts or tax increases will almost certainly still be required to pay for it. Analyses that do not account for those spending cuts or tax increases, whether they occur in the near term or in the longer term, obscure who will ultimately be hurt by them. Indeed, the very opportunity to obscure who will ultimately pay for the tax cuts likely explains why Congress pursues deficit-financed tax cuts more often than revenue-neutral tax reform or tax cuts accompanied by spending cuts.

A complete analysis of the tax plan including financing would most likely show that it would have a negative impact on many, and perhaps most, Americans…

…The primary purpose of the tax system is to raise revenues. Therefore, evaluating changes in tax policy while ignoring the impact of the policy’s reduction in revenues makes no sense. It ignores the very reason taxes exist. Indeed, absent consideration of financing, simplistic arguments that a 20 percent corporate rate is better than a 35 percent rate — the Republicans’ current proposal — would also imply that a zero percent rate is better than a 20 percent rate.

And a negative 20 percent rate would be still better! Once you consider the need for financing, such simplistic arguments fall apart.

Whether and how tax cuts are financed makes all the difference in the world. Consider two alternatives. One kind of well-designed tax reform can maintain the same level of revenues and boost living standards. Such a reform would inevitably increase taxes on certain activities and decrease them on others.

This type of reform could generate a modest boost in the level of economic output in the long run and, if so, would temporarily increase the growth rate. It could also increase living standards (even with no change in output) by eliminating wasteful tax incentives that encourage people to overconsume certain goods or services to maximize their tax benefits. Revenue-neutral reforms along these lines would almost certainly make some families better off and other families worse off. Who was hurt or helped would depend on the taxes that are changed.

Policymakers could also enact a tax cut financed by a reduction in spending. Just as a well-designed tax reform proposal could improve living standards by changing either consumption patterns or the growth rate, a tax cut financed by a reduction in spending could do the same — if the spending cuts are chosen wisely. As with revenue-neutral reform, some families would be made better off and others worse off after counting both the tax changes and the impact of the spending changes. (Former beneficiaries of the spending that is reduced would obviously pay a price.)

But the situation now is that House Republicans appear likely to release a bill that will cut taxes on net with no indication of how the resulting deficits will be paid for. As a result, we’re left in the dark about the legislation’s ultimate impact.

Conventional distribution tables for tax cuts show most of the gross benefits of tax cuts but not the impact of paying for them. When the proposal increases deficits and does not specify how those deficits will be addressed, the possibilities range from cuts to programs to low-income households to increases in taxes for high-income households.

We give a rough estimate, here, of the impact that three different approaches to financing a large tax cut would have on families across the income distribution. This example is not intended to show the actual distribution of the forthcoming House bill, but is broadly illustrative of the trade-offs involved in financing a tax cut that offers larger benefits for higher-income families than for lower-income families, as it seems likely the bill from House Republicans will do.

Specifically, we use the Tax Policy Center’s analysis of the principles for tax reform released by the Trump administration in April. This analysis found that families in every income group would see lower taxes on average from the plan as proposed, albeit with much larger increases in after-tax incomes for higher-income households.

But if the plan were financed by spending cuts or tax increases enacted at the same time, the distributional effects of the plan would change significantly.

The analysis considers three scenarios for financing. In each scenario, families pay more in tax or receive less in benefits to offset the cost of the tax costs…

…Families in the bottom 90 percent of the income distribution would be worse off on average under each of the three scenarios.

If anything, this…understates just how regressive the total ultimate impact of the Republican plan could be. While an equal payment per family would be regressive, the reductions in Medicaid spending that House Republicans passed earlier this year — which would have a significant impact on lower-income households and very little on the highest-income households — would be even more so.

The analysis…assumes that financing is enacted at the same time as the tax cut. In practice, policymakers can delay the enactment of financing for either a short or extended period. In such a scenario, even larger spending cuts or tax increases in the future would replace the required cuts today. Such an approach would introduce disparities across time as well as income.

Assuming Congress does not reverse course and enact progressive tax increases to offset the cost of the current tax cuts, older, higher-income Americans would likely see the largest increase in incomes, and younger, lower-income Americans would likely lose the most.

Enacting deficit-financed tax cuts allows policymakers to avoid the need to specify spending cuts or tax increases to pay for them and thus obscures the costs of the proposal. In addition, deferring the financing can itself reduce growth and reduce incomes even before the required financing policies are enacted. Those costs magnify the direct costs of any tax cuts.

Preliminary analyses by the Tax Policy Center of the Republicans framework (plus additional assumptions about unspecified elements of the plan from TPC) show the potential long-term consequences of deferring financing. In the short run, the TPC finds that the proposals would boost output. But over the longer run, the effects of mounting deficits and debt would turn the growth impact negative.

At the end of the first decade, the Tax Policy Center estimates that GDP will be 0.1 percent lower than it otherwise would have been, and at the end of two decades, it would be 0.4 percent lower. As a result, wages would likely fall over time, not rise (as recently claimed by the White House).

These results do not show the complete picture, however. The extent to which increased debt and deficits reduce GDP is moderated by an increase in domestic investment financed by foreigners. But this increase in foreign investment in the United States means an increased fraction of future GDP will need to be devoted to paying the return on that investment to those foreign investors. In other words, the gap between incomes generated by economic activity in the United States and incomes accruing to US nationals will grow.

Thus, gross national product (GNP), a concept that subtracts payments we make to foreigners on their US assets and adds payments we receive from foreigners — will decrease by more than GDP, falling by 0.2 percent after 10 years and 0.6 percent after two decades:

In circumstances like these, economists broadly agree that GNP is a better indicator of living standards for American households.

While the above analysis considers only the effects of additional debt, the spending cuts and tax increases ultimately enacted can themselves have negative effects on the economy. Indeed, classic economic arguments suggest that even when government spending is uncertain and varies over time, the most efficient tax system is one that attempts to maintain relatively constant tax rates.

Ignoring tax-cut financing is like doing only one side of cost-benefit analysis

Simplistic arguments in favor of a $1.5 trillion tax cut suggest that a $5 trillion tax cut would necessarily be even better. Clearly such arguments are missing something critical: balancing the costs against the benefits.

The prevalence of such arguments is part of a larger issue with the way tax debates are often conducted, focusing on GDP and downplaying or ignoring the impact of financing.

In recent years, analysts have increasingly assumed, in their models, that deficits resulting from tax cuts are ultimately paid for by tax increases or spending cuts several decades in the future. Thus, they recognize that deficits will be produced (by, say, large tax cuts) but basically assume the deficits will be remedied somehow, without showing the direct effect of those remedies on American households either now or in the future.

This approach can be useful in the context of official analysis of proposed policies, but it obscures the true economic tradeoffs. The promised gains from tax cuts in such cases — even when not eliminated as a result of years of increased borrowing — can amount to little more than borrowing heavily from future generations.

If we recognize the need for financing, a deficit-financed tax cut along the lines of the one House Republicans appear to be prepared to unveil is likely to be bad for the economy in the long run. It is likely to be particularly bad for working- and middle-class families.